The Office of Inspector General (OIG) recently completed an audit on their work plan of co-surgeon claim payments to determine if the payments complied with federal requirements. Per the OIG, their findings were as follows:

“From our 100 statistically sampled services, we found that 69 did not comply with Federal requirements. Specifically, these statistically sampled services included 49 that were incorrectly billed without the co-surgery modifier, 14 that were incorrectly billed without an assistant-at-surgery modifier, and 6 that were incorrectly billed as duplicate services. These statistically sampled service errors resulted in overpayments of $31,545. Based on the results of our statistical sample, we estimated that Medicare made $4.9 million in improper payments for physician surgical services during our audit period. In addition to the statistically sampled services, based on our review of the 127 corresponding services, we further found that 62 of these corresponding services did not comply with Federal requirements. These corresponding service errors resulted in overpayments of $24,471. Altogether, these statistically sampled and corresponding service errors occurred primarily because CMS did not have adequate system controls to identify and prevent such payments.” (Department of Health and Human Services, 2022).

CMS’ response was as expected: strengthen their system controls to ensure proper payments are made.

This is the precise reason why you should make sure you have your documentation and coding in order. Before we dive into the finer details of documentation requirements, let’s first review the differences between an assistant-at-surgery and a co-surgeon.

- An assistant-at-surgery (AAS), also known as a surgeon assistant:

- A helper or someone who doesn’t have their own separate role to play.

- Per American College of Surgeons, the first assist should be a qualified surgeon or a resident in an approved surgical training program.

- Residents who have appropriate levels of training should be provided with opportunities to assist and participate in operations.

- If a qualified surgeon or resident is not available, an AAS can be an NP, PA, or RN with specialized training.

- Is there to assist with things such as retraction, suction, positioning, visualization, trocar insertion, injection of local anesthetics, hemostasis, tissue handling, placement and securing of wound drains, closure of body planes, clamping, cauterizing, suturing, inserting, manipulating, cutting, ligating tissue, etc.

- Per American College of Surgeons, an AAS has additional surgical training meeting the national standard requirements.

- For hospital privileges, the AAS’ application will include the supervising surgeon he/she will be assisting and what duties they will be expected to perform.

- A co-surgeon:

- Is a physician, typically of a different specialty.

- Has their own role to play:

- Meaning one surgeon performs one portion of the procedure and the other surgeon performs a completely different portion of the procedure, or they may each provide the same procedure, but each surgeon works on one side, while the other is working on the opposite side.

Now Let’s Talk About That Documentation:

For assistant-at-surgery, follow these items when documenting:

- Surgeons document assistant-at-surgery services in the operative report.

- Best Practice Tip: Remember to document the AAS’ name and credentials.

- Best Practice Tip: When working with residents, it is important to remember the teaching physician is required to dictate a teaching attestation of work personally performed or present for and supervised, even if

- The assistant-at-surgery does not need to sign the operative report.

The operative report shows:

- The patient’s medical needs for the additional skilled services.

- The services provided by the assistant-at-surgery.

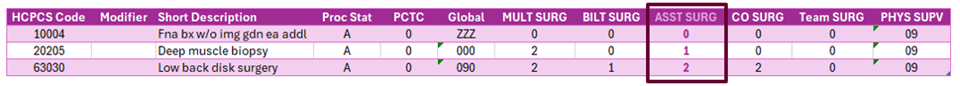

Medicare has rules for billing and payment of assistant-at-surgery services. The Medicare Physician Fee Schedule Relative Value File includes payment indicators for assistant-at-surgery services in the column titled “ASST SURG.” There are four indicators:

- 0 – Payment restriction for assistants at surgery applies to this procedure. Submit documentation to support medical necessity.

- 1 – Statutory payment restriction for assistants at surgery applies to this procedure. Assistant-at-surgery may not receive payment.

- 2 – Payment restriction for assistants at surgery does not apply to this procedure. Assistant-at-surgery may receive payment.

- 9 – Concept does not apply

Here you can see 3 examples of different procedures with 3 of the 4 payment indicators.

*Note – search results were exported to a spreadsheet for sorting and formatting purposes.

About Those Modifiers:

- Use modifier -80 when the assistant-at-surgery service was provided by a physician.

- Use modifier -81 when an assistant surgeon is providing minimal assistance to the primary surgeon or is not present for the entire procedure.

- This modifier pertains to physician’s services only.

- Use modifier -82 when a qualified resident surgeon is not available in a teaching facility and another physician is acting as an assistant surgeon:

- The unavailability of a qualified resident surgeon is a prerequisite for use of this modifier and the service must have been performed in a teaching facility.

- The circumstance explaining that a resident surgeon was not available must be documented in the medical record. This modifier is not intended for use by non-physician providers.

- Use modifier -AS for assistant-at-surgery services provided by a physician’s assistant (PA), nurse practitioner (NP), or clinical nurse specialist (CNS).

For co-surgeons, follow these items when documenting:

- Each surgeon dictates a separate operative note indicating the services performed.

- Best Practice Tip: Remember to document the primary surgeon’s name and credentials. This may be required for prior authorization purposes.

- Each surgeon documents each other on their respective operative reports.

The operative reports show:

- The patient’s medical needs for the co-surgeon services.

- The services provided by each surgeon.

- A detailed account of the services provided by the surgeon on their respective operative notes, and an overview of the co-surgeon’s role.

- For example:

- Surgeon A performs the opening for/closing of exposure – this would include:

- A detailed account of the surgeon’s technique to open the patient for exposure, then surgeon A stepped away from the field, maintaining sterile protocols,

- Then a brief statement of surgeon B’s portion,

- Then surgeon A documents his/her technique for the closure.

- Surgeon B performs the substantial portion of the procedure – this would include:

- A brief statement of surgeon A’s role in opening for exposure,

- Then a detailed account of their technique and all services performed,

- Then a brief statement of surgeon B’s role in closing the incision.

- Surgeon A performs the opening for/closing of exposure – this would include:

- For example:

- A detailed account of the services provided by the surgeon on their respective operative notes, and an overview of the co-surgeon’s role.

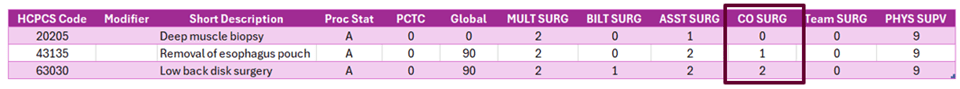

Medicare has rules for billing and payment of co-surgeon services. The Medicare Physician Fee Schedule Relative Value File includes payment indicators for co-surgeon services in the column titled “CO SURG” There are four indicators:

- 0 = Co-surgeons not permitted for this procedure.

- 1 = Co-surgeons could be paid. Supporting documentation is required to establish the medical necessity of 2 surgeons for the procedure.

- 2 = Co-surgeons permitted. No documentation is required if 2 specialty requirements are met.

- 9 = Concept doesn’t apply.

Here you can see 3 examples of different procedures with 3 of the 4 payment indicators.

*Note – search results were exported to a spreadsheet for sorting and formatting purposes.

Reimbursement Guidance

Understanding reimbursement for assistant-at-surgery and co-surgeons can be tricky but is an important piece of the revenue cycle. Let’s review:

- Physician acting as an assistant surgeon – modifier -80 – this scenario will reimburse at 16% of the Medicare Physician Fee Schedule.

- PA, NP, CNS acting as an assistant-at-surgery – modifier -AS – this scenario will reimburse at 85% of the above mentioned 16%, or 13.6% of the Medicare Physician Fee Schedule.

- Co-Surgeon – modifier -62 – this scenario will reimburse each physician at 62.5% of the Medicare Physician Fee Schedule.

When reviewing paid claims, it is recommended to ensure that all claims billed with modifiers are paid accordingly. This can help identify any bigger issues you may have, such as a payer not reimbursing properly.

Final Notes

- If you are billing for a procedure that requires co-surgeons and if both surgeons do not submit their claims with the -62 modifier, the claim will be denied.

- Per CMS – If you are billing for a procedure that requires prior authorization, you must also request prior authorization for an assistant-at-surgery that will be billed with modifiers -80, -81, -82, -AS.

- The Medicare Claims Processing Manual (Chapter 12, Sections 40.8), it is indicated the two surgeons cannot be in the same specialty with the use of the -62 modifier.

If you are a surgeon and work with assistants-at-surgery and/or co-surgeons, you or your practice can be at risk for an audit; let LWCI help you establish an audit plan to add to your current compliance program. Contact us today to get started working on your audit needs.

LW Consulting, Inc. (LWCI) offers a comprehensive range of services that can assist your organization in maintaining compliance, identifying trends, providing education and training, or conducting documentation and coding audits. For more information, contact LWCI to connect with one of our experts!

| Sources: |

| Department of Health and Human Services. (2022, November). Medicare Improperly Paid Physicians for Co-surgery and Assistant-At-Surgery Services that were Billed Without the Appropriate Payment Modifiers. Office of Inspector General. https://oig.hhs.gov/oas/reports/region1/12000503.pdf |